Life Insurance in and around Silver Spring

Life goes on. State Farm can help cover it

What are you waiting for?

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

People choose life insurance for many different reasons, but the primary reason is almost always the same: to ensure the financial future for the people you're closest to after your passing.

Life goes on. State Farm can help cover it

What are you waiting for?

Silver Spring Chooses Life Insurance From State Farm

But what coverage do you need, considering your situation and your loved ones? First, the type and amount of insurance you select should accommodate your current and future needs. Then you can consider the cost of a policy, which depends on your age and how healthy you are. Other factors that may be considered include body weight and personal medical history. State Farm Agent Michael Palmiotto can walk you through all these options and can help you determine how much coverage is right for you.

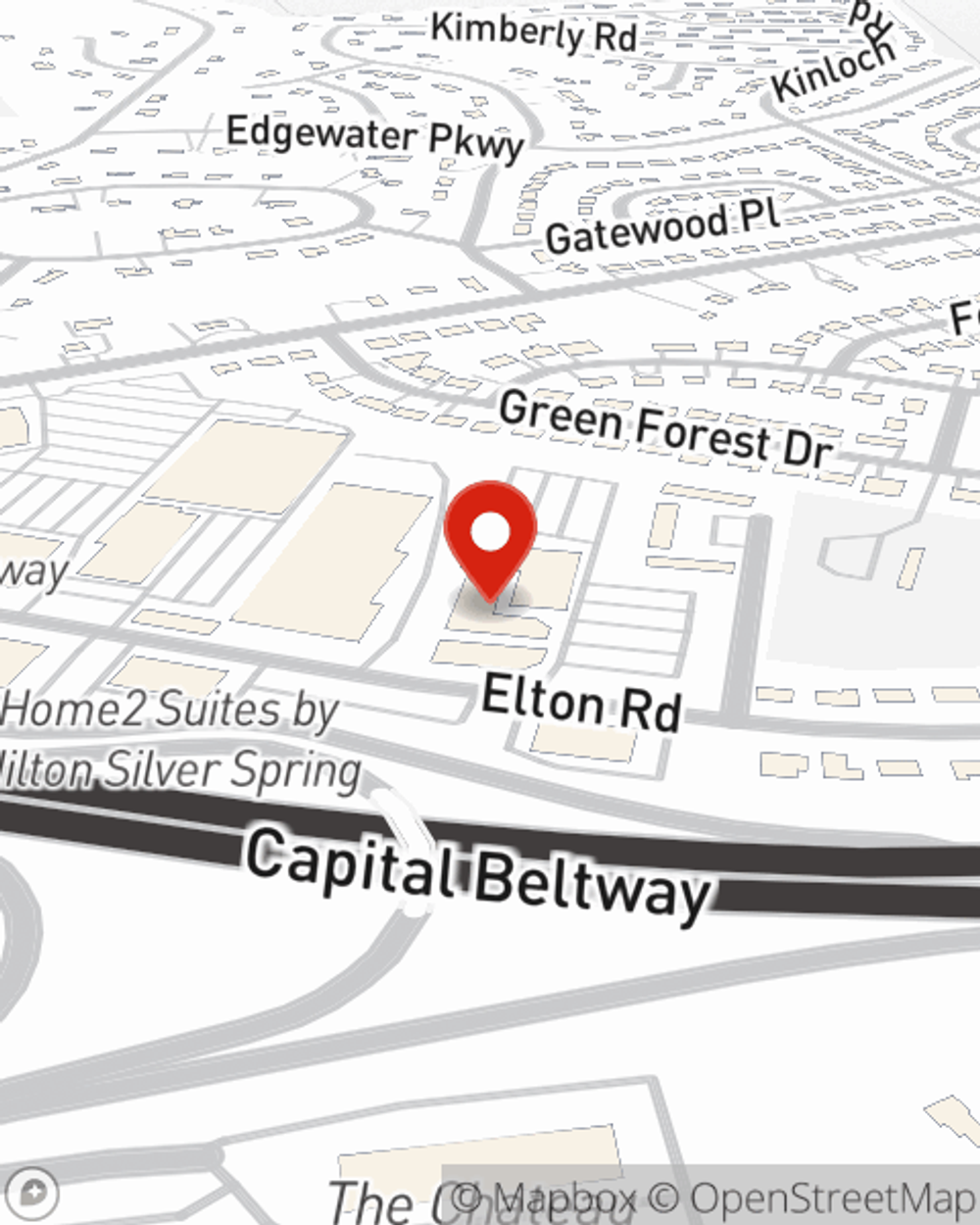

Visit State Farm Agent Michael Palmiotto today to check out how the trusted name for life insurance can help you rest easy here in Silver Spring, MD.

Have More Questions About Life Insurance?

Call Michael at (301) 431-2020 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Michael Palmiotto

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.